COVID-19 shocks Global Trade (Part I)

- Arjun Bhuwalka

- Jul 14, 2020

- 4 min read

Updated: Aug 4, 2020

Contributions by Rohini Chowhan

Increased dependence on global trade and supply chain in the wake of the COVID-19 pandemic is making many economies and businesses rethink their supply strategies

Magnitude of the Economic Crisis

The world has experienced several major economic shocks in the past that have left it battered for years. However, the impact of the current pandemic threatens to surpass all of them. The economic crisis is expected to also increase extreme poverty and social injustice, heighten political tensions, and fuel more trade protectionism.

World GDP Decline

IMF estimates published in April 2020 projected the world GDP in 2020 to contract -3.0% but revised it lower in June to -4.9%, as the crisis worsens. The decline could be even deeper and prolonged as the world is still in the midst of the COVID-19 pandemic and fears of a second-wave remains. Similarly, other organisations also expect World GDP to decline in 2020 with some predicting a gloomier situation.

World GDP forecast

IMF estimates that the Advanced Economies will be hit the hardest with their GDP projected to fall -8.0% in 2020. Emerging economies will not escape unscathed but are expected to be less impacted with their GDP declining -3.0% (-5.0% ex-China).

The world GDP growth, as per IMF, is expected to rebound to 5.4% in 2021 with the help of stimulus packages but slowdown again in 2022 as a manifestation of waning relations with China. However, uncertainty prevails until the pandemic subsides or a cure is developed for the world to return to a new-normal.

Impact on Global trade

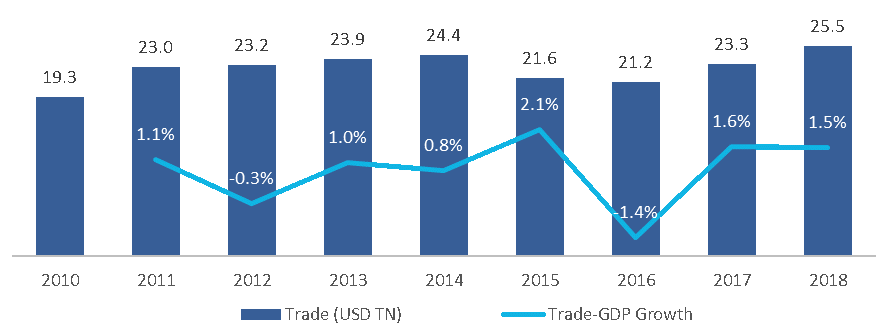

Global trade, which was USD 25.5T with a trade-to-GDP ratio of 59.45% in 2019, plays a major role in the global economy. It is dominated by goods (77% share; driven by manufacturing) and the remaining by services (23% share; driven by travel and transport). In the last 10 years, global trade growth has outpaced GDP growth, indicating the increasing role of global trade.

However, global trade is among the worst affected by the COVID-19 pandemic as goods and passenger transport worldwide came to a grinding halt to contain the spread of the virus. According to UNCTAD, global trade fell 5.0% in 1Q2020, expected to decline 27% in 2Q2020, and decline 20% in 2020. The manufacturing sector will bear the brunt as it came to a standstill due to factory shutdowns or delays in procurement of intermediate parts. The Purchasing Manager’s Index (PMI) reflects the impact as it fell over 5% in 1H2020, the largest slide in 10 years. Further, export related job losses touched 3.6 million in China and 1.5 million in India.

The timing of the pandemic has only added to the existing pressure on global trade. In the last few years, global trade growth has staggered due to rise in trade protectionism and the US–China trade war, a fallout of China’s increasing share of global trade (~40% finished good and ~20% intermediate parts). As a result, the shutdowns in China will have a widespread impact across the world. The shutdown is estimated cause a 2% contraction (annualized basis) in China’s exports translating to approximately USD 50 billion in global trade losses.

Impact of COVID-19 on Trade in different sectors

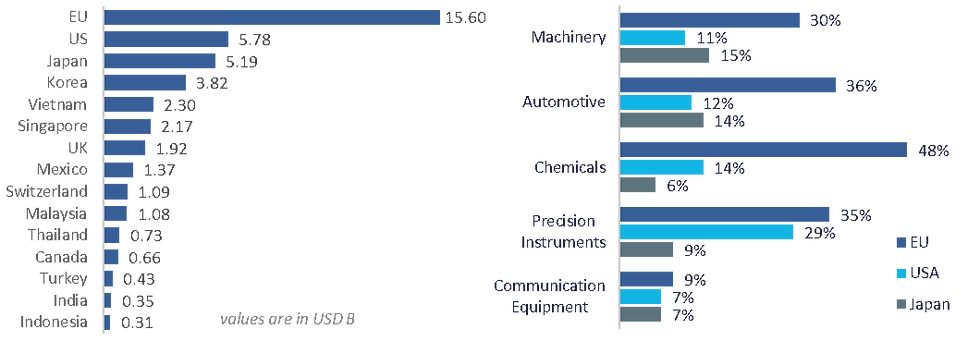

The disruption in global trade has impacted certain industries disproportionately higher than others, especially those that are dependent on a complex global supply chain.

Merchandise Trade (USD 19.8 trillion)

Commercial Services (USD 5.9 trillion)

Regaining Control – the case for restructuring global trade

In the last couple of decades, global trade prospered due export-led industrialization of emerging economies, but lowered trade diversification – 10 countries account for 50% of global trade, with China at the epicenter. This coupled with global trade stalling due to the pandemic, has forced the world to re-examine if global integration has become a misnomer for interdependence.

Several countries intend to reduce reliance on imports, especially from China, as they scramble to protect their economies from future disruptions. Although, it will not be easy to undertake large-scale restructuring in the near term, it might however, be the case for pushing localization to drive growth.

1) Prioritize national health and food security

Countries are focusing on restoring self-sufficiency in agriculture and pharmaceuticals that weathered strong supply shocks and major political interventions recently. Agricultural production is expected to be localized and inter-regional trade will increase to shorten the supply chain for critical raw materials.

USA signed a contract with a local company to create the nation’s first stockpile of key ingredients to make medicines.

2) Diversification

Emerging economies that depend largely on exporting raw material or components to China will seek to attract other countries for diversifying trade and growing the local economy.

Vietnam plans to attract electronics, consumer appliances, electric vehicles, footwear and toy makers through preferential tax rates and tax holidays; and India plans to increase exports and has announced USD 6.6 billion incentive scheme for local and global players to make India a hub for manufacturing electronics – particularly smartphone assembly.

3) Import substitution, near-shore sourcing

Highly-traded sectors, such as automotive and communication equipment, that rely on imported parts and assembly from different geographies will look to diversify closer to home or in low tariff areas.

Japan has earmarked USD 0.2 billion to shift production from China to Southeast Asian countries; biggies such as Nintendo, HP, Dell, Apple, and Microsoft are seeking to move some of their assembly manufacturing from China to Vietnam, India and Thailand.

4) Local Manufacturing

Financial incentives are being doled out by countries to bring production back home and boost local manufacturing to drive indigenous growth and tackle unemployment.

Japan has allocated USD 2 billion to shift production home from China; India’s ‘Make in India’ program will offer production linked cash incentives worth 4 to 6% of incremental sales over five years on goods manufactured locally; and the UK plans to localize infrastructure sector by cutting imports to zero.

History shows, US President Woodrow Wilson’s ‘America First’ movement to become economically self-dependent, went on to make USA, then a victim of Spanish flu and WW I, a superpower over the next two decades. Similarly, India’s call of self-reliance or ‘Atmanirbharta’ is a lesson from that alchemy while USA, is bracing for ‘Make America Great Again’!

In subsequent articles, we assess COVID-19’s impact on trade of developed economies and emerging economies, and the measures they plan to take to reduce trade-linked economic and supply shocks in the future, and leverage the opportunity revive economic growth.

Comments