COVID-19 shocks Global Trade (Part III) – Impact on Emerging Economies

- Arjun Bhuwalka

- Jul 21, 2020

- 8 min read

Updated: Aug 3, 2020

Contributions by Rohini Chowhan

COVID-19 has shaken the foundation of economic prosperity of emerging economies, forcing them to foster new trade relationships to restore exports and foreign investment

Economic Prosperity Reversed

COVID-19 has dampened years of economic progress of the emerging economies by contracting their ‘vital sources of income’ – foreign capital inflows, worker remittances, and exports receipts. Although lockdowns have helped delay the peak, it has also led to massive unemployment and output loss, especially for small and medium enterprises (SMEs).

IMF estimates (July 2020) that the GDP of emerging economies will fall -3.0% in 2020, a reduction of 2.0%-points compared to previous estimates (April 2020). Further, currencies of some of the major emerging economies have depreciated by 15% – inflating import prices, worsening trade gap, and reversing many of the gains from globalization.

Trade Destabilized

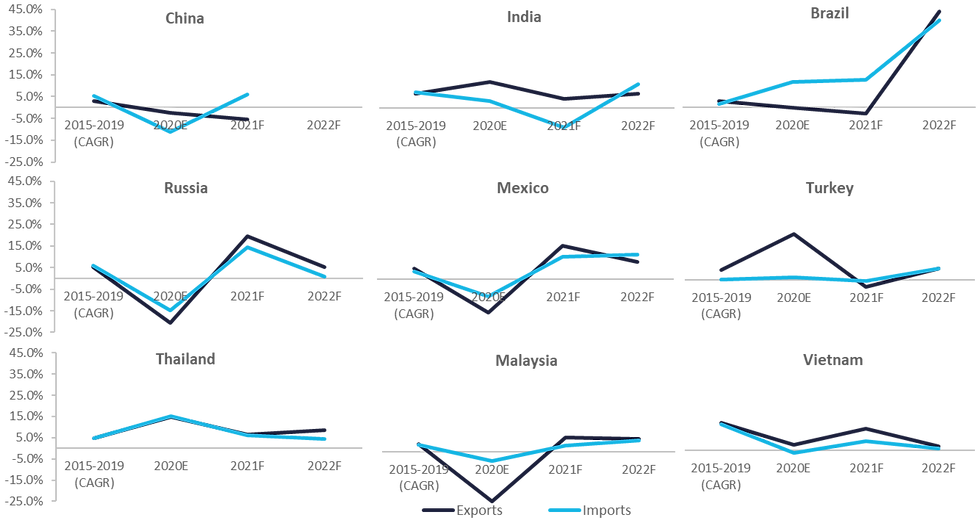

Global trade of emerging economies is projected to fall by -9.4% in 2020. Exports and imports are set to plunge by -9.6% and -8.2%, respectively, as many of these economies are concentrated on a few sectors – agriculture, mining, oil, manufacturing, and tourism – sectors hit hardest due to COVID-19 restrictions.

Lower demand from USA and China, among the top 5 trading partners for most emerging economies, have added to their losses. Exports of automotive, machinery, communication equipment, chemicals, textiles, and apparels have been severely impacted due to a 2% annualized contraction in Chinese manufacturing.

Emerging economies’ trade is expected to rebound to 9.4% in 2021 due to fiscal interventions, efforts to strengthen capabilities of assembling parts (currently manufacture) into finished goods (produced by China), and consolidate their supply chain.

Trade Measures – Present Scenario and Outlook

A shift in trade flow is certain as emerging economies scramble to regain lost foreign capital by strengthening - manufacturing skills, export capacity, lowering tariffs, and ramping up exports in areas vacated by the US–China trade war, particularly low-end manufactured goods.

India

India posted a trade surplus in June 2020 for the first time in 18 years as imports fell more than imports. Until April, export losses had touched ~60% as 30 sectors faced 70% to 80% order cancellations, job losses, and rising non-performing assets (NPAs) of exporting units. Further, India had failed to seize the opportunities from the US-China trade war (3 out of 56 companies came to India).

However, this time around, India wants to capitalize on the growing global discord towards China coupled with domestic consumer’s negative attitude for Chinese goods, fueled by geopolitical skirmishes and COVID-19. India intends to become ‘Atmanirbharta’ (self-reliant) by increasing manufacturing share of GDP to 25% by 2025 from 13.7% in 2019.

China Relations – India’s dependence on China (5.3% of exports and 13.8% of imports) came to light over pharmaceuticals (~90% of critical therapeutics are imported). As a result, proposals are being made to levy COVID-19 duties of ~15% on non-essentials, suspend concessions, formulate standards to restrict low-quality cheap imports for ~370 items, tighten standards for automobile industry, and curb ‘opportunistic takeovers of firms’ by China (funded 18 of the 30 startup unicorns).

Import Substitution – Proposal to reduce custom duty on plant and machinery from Japan, USA and Europe to substitute Chinese imports.

Localization – Under its ‘Make in India’ plan, India is seeking to restrict imports in 12 sectors, approved a USD 1.8 billion package to locally produce drugs, and to offer production linked cash incentives (PLI) on locally manufactured goods (allocated USD 6.7 billion for five global smartphone manufacturers). It slashed the effective corporate tax to 25.2% and for new manufacturers to 17.0%, and plans to set up industrial zones for direct government procurement to give fillip to local firms.

Free Trade Agreement (FTA) – After a lot of resistance, India is expected to move to a broad-based FTA with EU (Bilateral Trade and Investment Agreement) and has invited EU to invest in its market, However, a bilateral trade agreement with the USA is not in sight in the near future.

Brazil

Brazil, after years of recession, has recently integrated with global trade under President Bolsonaro’s vision of free market capitalism. However, the COVID-19 impact may force it hold on to its traditionally restrictive trade policies - high tariffs (highest among emerging nations), discriminatory tax subsidies, and limiting foreign investment in agribusiness.

FTAs – It has signed FTA agreements with Mercosur and EU, bid for a full OECD (2017) and WTO GPA (2020) membership, and initiated trade dialogues with Japan, Lebanon, Indonesia, Vietnam Canada, Singapore and South Korea. USA is still looking to freeze a free trade deal to reduce barriers on trade, investment and supply chain capacity.

China Relations – Brazil shares a strong relation with its largest trading partner China (poured in USD 90 billion across 100 projects since 2005) despite political friction over Huawei’s participation in 5G rollout and Brazil’s pro-America rhetoric. Brazil has also gained from US–China trade war as a substitute exporter of soybeans and cotton.

Russia

The Russian economy, dealt a huge blow from low demand of oil leading to a depreciated Ruble, has mostly sought China to soak its exports.

China Relations – Politically, Russia has been China’s most vocal defender over the COVID-19 crisis and each side sending timely aid. Thus, despite the pandemic, Russian exports to China surged 17% in 1Q2020 as China stockpiled low priced oil. Work is also underway on 30-year contract worth USD 400 billion to supply natural gas. They are also on track in 2020 – designated as the year of Russian-Chinese Scientific, Technical and Innovation Cooperation – deal with Huawei, and MTS to rollout 5G and provide other technologies such AI, IoT. In the long term, a concern is that China plans to pivot to green energy.

Mexico

Mexico, a major supplier of automotive and electronic parts, is pinning its hope on the new USCMA (USA-Canada-Mexico) agreement. It is touted as the next big manufacturing hub and the biggest beneficiary of trade with USA – a low-cost border country and a free trade deal. FDI of USD 12 to 19 billion per year is expected to be re-directed from the US, China, and Europe to Mexico, pushing its annual GDP growth rate to 4.7%.

USCMA – It requires ~75% of materials in assembly and production of automobiles to be sourced from North America to qualify as duty-free, implying re-shoring of supply chain from China to Mexico. An added attraction of having plants in Mexico is that firms can sell made-in-Mexico vehicles globally under its 45 other trade agreements.

Turkey

The trade deficit of Turkey doubled in 1H2020 compared to a year ago as exports slumped 20% due to low demand from EU and Russia; especially Germany its largest trading partner.

Import ban – The trade deficit has led to ‘practically banning’ imports by using a detailed red line method of customs inspection.

Swap Line – On the other hand, Turkey is utilizing its FTAs and G20 partnership to discuss a swap line with countries with which it has a trade deficit to dole it out from its currency crisis.

China Relations – Turkey has very recently initiated talks with China to reduce its trade deficit (exports is 1.9% and imports is 9.9% of total trade), by boosting exports of motor vehicles, medical equipment, electrical machinery, and agricultural; and inviting investments in specialized R&D free-trade zones. In turn, it has showed readiness to cooperate with China on its Belt and Road Initiative (BRI).

Thailand

Thailand’s rapidly ageing economy is made up of 70% of exports (tourism is 20% of GDP), held together during the pandemic by farm and food exports (rose 22% in 1H2020) and sale of gold.

Foreign Investment – In 1H2020, Thailand approved investments by USA (11 projects worth USD 70 million to move production of defense and advanced materials), China (54 projects worth USD 900 million), Japan (57 projects worth USD 500 million), Singapore, and Taiwan. However, USA has suspended Thailand’s duty free status (GSP) over labor laws in April 2020.

Tourism – Plans to form ‘travel bubbles’ with countries that have low COVID-19 rates including China, South Korea, Vietnam, Australia and New Zealand, to make up for USD 47 billion in revenue losses.

China Relations – Thailand relies on China for trade and tourism (27.6% of foreign visitors annually) and has signed a Railway agreement ‘Contract 2.3’ worth USD 1.58 billion despite ruffled feathers over issues such as Mekong river, tax exemptions on online trade, Chinese loan financing set in US dollars, and fruits price war.

Malaysia

Malaysia has a small domestic market that depends on exports, mostly to Asian countries (70% share), that is fairly balanced across its trade partners. However, the pandemic has hit its exports and the only saving grace is continued demand for rubber gloves and agriculture products.

The country has several FTA and regional agreements, and awaits for world trade to reopen to get its exports and tourism (accounts for ~14% of GDP and has incurred ~USD 21.5 billion losses) on track. Stimulus packages worth USD 4.5 billion have been rolled out to help tourism and USD 232 million to aid agricultural sector.

China Relations – Malaysia is embroiled in a standoff with China over the South China Sea issue but continues to supports BRI as China is its main source of FDI (quadrupled in the manufacturing sector and created more than 73,000 jobs since 2015).

Vietnam

Vietnam’s prosperity, driven by its strong manufacturing and processing industries and a strong export portfolio of agro-fishery-forestry products, textiles, footwear, machinery and electronic parts, has dented only slightly by COVID-19. It is among the biggest beneficiaries of the US-China trade war (26 of 56 firms relocated) and is expected to become one of the next major export hubs. However, to achieve this it needs to ramp up - labor supply, sub-contractor supplier base, high-tech manufacturing and infrastructure.

EU FTA – Vietnam is the only country in South-East Asia, after Singapore, to ratify its FTA with the EU (EVFTA) that removes tariffs on 85% of Vietnamese goods and lifts import duties on 49% of exports to EU. This move is expected to increase Vietnam’s GDP by 2.4% by 2030. Also, an FTA with Russia (EAEU - Eurasian Economic Union - TASS) is in the offing.

US FTA – It wants to sign a trade deal with USA with which it has ‘preferred access’ and their trade increased by ~10% in 1H2020 despite the pandemic.

Regional Comprehensive Economic Partnership (RCEP) – It is already a part of the proposed RCEP to form free trade in the Asia Pacific region.

Investments – The government has proposed to reduce corporate tax up to 30% to promote private investment in SMEs (constitute 97% of total business).

In order to attain pre-COVID-19 growth, self-reliance, export growth, and use of sophisticated technology is reverberating hard and fast among emerging economies, especially among those that are reliant on China for trade. It is imperative for them to gain competitive advantage in smart manufacturing and custom order capabilities, especially for complex value chains such as automotive and electronics. Additionally, favorable and transparent government policies for non-tariff barriers, customs, and labor laws will be required to improve ease of doing business, a key factor in attracting new investors. Nevertheless, with the median age of the workforce below 29 years, high internal consumption, and lower labor costs, emerging economies have a lot to look forward to!

Competing with China is no easy task and despite the growing negativity among many towards China, it will be important to see how China responds to the situation. In the next and final article, we analyze how COVID-19 has impacted China’s reputation, why China’s growing dominance over global trade is a concern, and how China’s plans to tackle these challenges.

Comments