COVID-19 shocks Global Trade (Part IV) – China’s Dominance and Impact

- Arjun Bhuwalka

- Jul 28, 2020

- 5 min read

Updated: Aug 4, 2020

Contributions by Rohini Chowhan

COVID-19 pandemic has jolted China, both politically and economically, but China will continue to grow, albeit slower, as global trade is deeply rooted to it.

China’s Growth Trajectory

Over the last 40 years, when China began implementing free market reforms in 1979, its real annual GDP growth rate has averaged 10.1%, a pace described by World Bank as ‘the fastest sustained expansion by a major economy in history’. In 2019, China’s annual GDP was USD 14.3 trillion, accounting for 16.3% of world GDP and only second to USA, which accounted for 24.4% of world GDP.

China has achieved unprecedented economic growth through sustained efforts to transform from a closed-agrarian economy into the world’s largest factory and export hub. This is backed by a mammoth ~800 million workforce, labour cost arbitrage, rapid infrastructure development, advances in manufacturing, and a high-tech supplier ecosystem.

China’s Influence on Global Trade

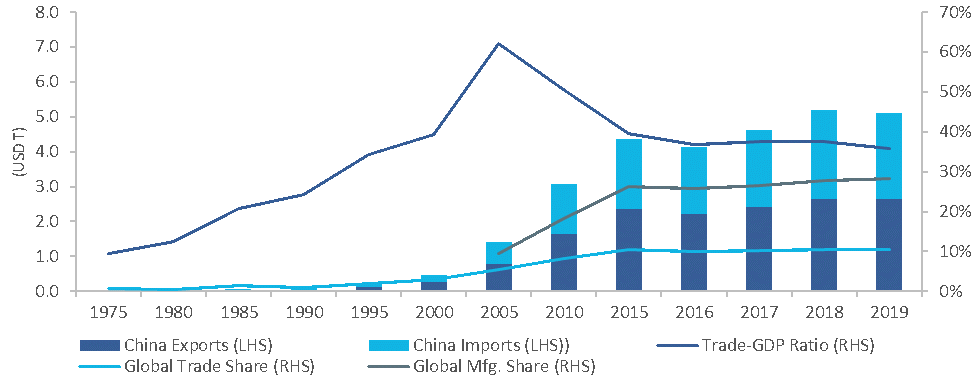

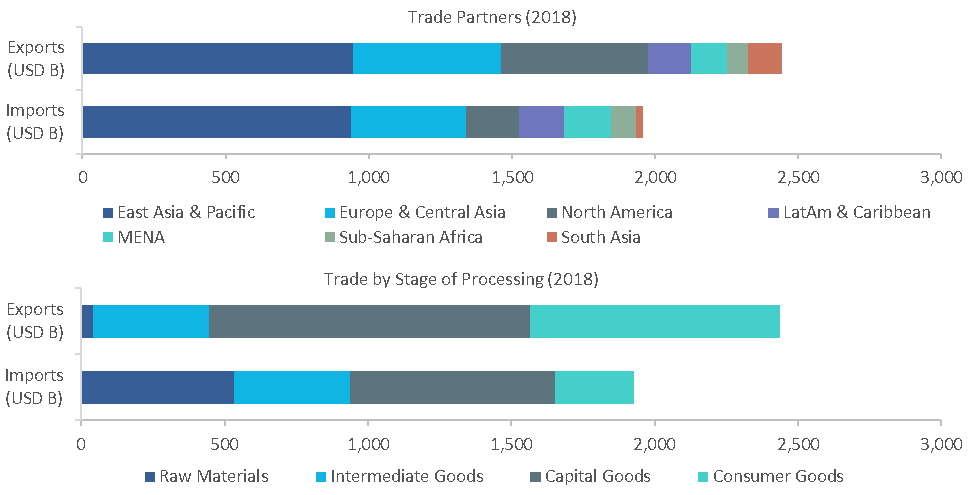

China is today the nerve center of world trade, an outcome of its ‘Coastal and Western development’ strategies in 1989 and 1999, respectively. As of 2019, it has the largest share of global trade at 10.4% and the top trading partner of the 4 out of 8 advanced economies and 6 out 8 emerging economies we covered in our previous articles. Its trade (USD 5.1 trillion in 2019) is a critical component of its economy with a trade-GDP ratio of 36% and increased over the last two decades at CAGR of 13.3%.

As the world’s largest manufacturer (28.2% global share in 2019) and the largest merchandise exporter and second largest merchandise importer, China has become indispensable at every stage of production. For instance, it supplies 80% of global automotive parts (USD 70 billion), its the world’s largest producer of consumer electronics (90% of mobile phones and computers, and 70% of televisions), and leading producer of materials such as steel, rare earths, and several others.

Changing Global Trade Relations with China

China’s increasing influence on global trade, political notoriety, and recent supply shortages due to the COVID-19 pandemic have forced the world to examine their trade strategies. Further, while China’s economy and trade have grown, several factors have diminished some of its attractiveness.

Rising Labour Cost – Overall wages and manufacturing wages have risen 2.4 times and 2.5 times, respectively, since 2010

Tariff and State Subsidies – Higher tariffs on products at 8.5% compared to global average of 5.2%

Non-Tariff Barriers (NTBs) – Import approvals, stringent labeling & certifications, and customs delays

Intellectual Property Infringement – IP violations of foreign technology and security concerns over 5G

Defective COVID-19 Supplies – Dumping low-cost, cheap, and faulty testing kits, masks, and PPEs

Geo-Political issues – Skirmishes in Ladakh Valley, Tibet, Hong Kong and Taiwan; land disputes with Laos, Mongolia, Bhutan, Nepal, Myanmar; and maritime disputes over South China Sea, Sea of Japan, Spratly Islands, and Mekong River.

As a result, many of the developed economies and emerging economies are adopting trade measures to reshore or nearshore production to low-cost neighbours. Recent surveys indicate a spurt in procurement inspections of exporting companies in Vietnam, Myanmar, Philippines, and Bangladesh; a Gartner survey of 260 global supply chain leaders found that 33% plan to move sourcing and manufacturing out of China in the next couple of years; and another survey points out that footwear, textiles, wood and optical devices are some of the sectors most likely to relocate. The impact of relocating is estimated to result in China incurring an output loss of USD 2.3 trillion over the next 10 years, equal to a GDP loss of 1.6% per year.

This has opened a fortuitous window for countries to forge new trade partnerships, revive economic growth, and become export hubs by leveraging demand ceded by China.

Countermeasures by China

China’s trade declined by 8.1% (exports -9.3% and imports -7.0%) in 1Q2020 due to shutdowns but rebounded by 5.1% in June 2020 (exports +4.3% and imports +6.2%). Subsequently, several analyst firms have raised their forecast of China’s export growth rate for 2H2020 from -9.0% to 0.0%. Similarly, IMF estimates that the GDP of China will grow by 1.0% in 2020 in contrast to world GDP declining 4.9%.

This is a result of China managing to be ‘first-in-first-out’ of the COVID-19 pandemic although the virus originated in China and rest of the world remains embroiled in it. China has also loosened its supply-side restrictions and used this opportunity to broaden its market share by fulfilling demand for medical goods, textiles, laptops, and phones from its ASEAN peers and USA. In the same vein, it is supporting WHO to fight the COVID-19 pandemic (as US withdrew) by announcing an aid of USD 20 million and supplying critical drugs to 120 countries and 100 health experts.

It intends to further counter the international backlash with assertiveness and ‘wolf warrior’ diplomacy. The President, at the Politburo Standing Committee, declared a bottom-line thinking, calling for mental and material preparations to counter the adverse external environment.

Economic Measures

Betting on Domestic Demand – Over the last 15 years, China has reduced its trade dependency (62% in 2005 to 36% in 2019) and is focusing on its huge domestic economy (internal consumption is 55% while exports are 18% of GDP in 2018). It has earmarked USD 1.4 trillion for its ‘Made in China 2025’ plan to ramp up its infrastructure network, manufacturing base, and to achieve 70% self-sufficiency.

Technology – China is set to release its ‘The China Standards 2035’ blueprint that will set global standards for emerging technologies such as 5G, IoT, AI, etc. and as part of its ‘Made in China 2025’ to become a leader in hi-tech innovation for Tier-I and Tier-II companies abroad.

Attract Businesses – Over the last two years, China has made significant changes in its policies to improve ease of doing business rising to 31st rank (2019) from 46th (2018). This is also reflected in the positive trade sentiment of SMEs willing to continue doing business in China.

International Agreements

China is seizing the opportunity to enter partnerships with nations that are rely on it for FDI and those that have tumultuous relations with USA and others.

Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) – It has expressed interest in joining CPTPP that USA and India abandoned.

China-Latin American and the Caribbean States Cooperation (CELAC) – China will provide funds for public health projects, send medical teams, increase vaccine R&D, and support food security in the region.

Sino-Iranian Partnership – China is in talks to invest USD 400 billion in Iran’s 25-year plan to modernize infrastructure, telecommunication, and defense and security, and in return get preferential access to Iran’s oil production.

Supply Chain Measures

Free Trade Ports – China plans to prop-up foreign capital utilization in its free trade ports such as Hainan, Xiong’an, and Greater Bay (base for 20 of the top 500 global firms) to maintain its supply chain and support its capital-intensive BRI project.

Belt and Road Initiative (BRI) – It is trying to salvage BRI by re-positioning it as a ‘Health Silk Road’ given its monopoly in medical trade and the route’s medical delivery potential.

The Future of Global Trade

As the world continues to deal with an unprecedented global health and economic crisis, it is still uncertain whether in the long-term global trade will “de-Sinicize” or countries will draw even closer to China, given its aggressive stance on solidifying manufacturing, increasing foreign investment, and strengthening military power.

The COVID-19 pandemic has shaken every economy, pushing for ‘self-reliance’ and restructuring strategic supply chains to keep the ‘global value chain’ moving. It seems that developed countries are more likely to adopt a ‘China plus One’ strategy to test the waters and emerging nations will continue to seek China’s involvement while also benefiting from China’s trade fall outs to spur their economic recovery.

A strategic balance between self-reliance and new trade partnerships will be the key to achieving economic resiliency, improving livelihoods, and effective integration with the world.

Hopefully, the pandemic that has soured many a relations will depart with a new order for Global Trade that is based on trust, transparency, and fair-trade policies beneficial to all equally.

Comments