COVID-19 shocks Global Trade (Part II) – Impact on Developed Economies

- Arjun Bhuwalka

- Jul 14, 2020

- 6 min read

Updated: Aug 3, 2020

Contributions by Rohini Chowhan

Developed economies are among the most impacted by the trade disruption due to COVID-19, forcing them to re-think their global trade strategy and move towards economic self-reliance.

Unprecedented Economic Downturn and Dismantled Supply Chain

The global economy is severely affected by the COVID-19 pandemic. The world GDP is estimated to decline sharply in 2020 and developed economies will be among the hardest hit. This crisis has heightened the issues of food and medical security, trade dependency, and the need for multilateral cooperation.

Impact on International Trade

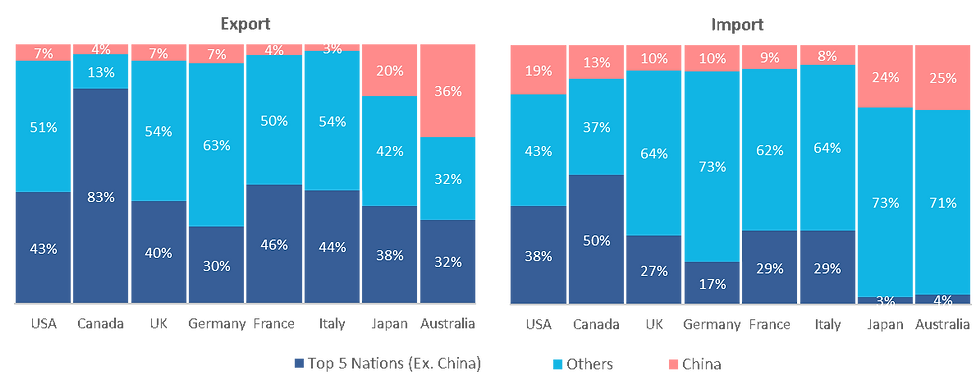

Over the last couple of decades, trade has been the mainstay of global economic growth, but the COVID-19 pandemic has brought global trade to a standstill. According to UNCTAD, global trade fell -5.0% in 1Q2020, expected to decline -27% in 2Q2020, and 20% in 2020. Developed economies are facing the maximum brunt, accentuated by lower trade diversification, as their trade volume is set to plummet by -13.4% in 2020. Automotive, electrical, electronics, machinery, aircraft, and oil are the most affected sectors by the economic impact of COVID-19 as they rely heavily on imports from China.

Trade Measures - Present Scenario and Outlook

The disruption in global trade has revealed some major trade-offs that signal a need for change. Further, the increased dependency on global trade, especially with China, is driving many developed economies to rethink their trade strategy to prevent future disruptions in critical supplies and to revive economic growth.

United States

The pandemic has left USA’s trade deals in lurch as it banks on medicines from China and India (USA imports ~50% of generic drugs from India which imports ~70% of API from China). This forced USA to lift the additional 25% duty ban on 19 Chinese items. However, its long-term plan to ‘Make America Great’ again continues with a reshoring strategy rather than just shifting production back home from China.

Reshoring – Shifting manufacturing, technology, and automotive to neighbours Mexico, lower costs, and Canada under the USMCA agreement (imports from Mexico have risen by 14% since 2017).

Regionalization – Increasing trade with Taiwan and Vietnam (inspections by US firms rose by 9.7% in 2019). Vietnam accounted for ~50% of the USD 35B of US imports that shifted from China to other Asian countries in 2019 due to the US-China trade war.

Protectionism – New tariffs of up to 100% on goods from Germany, France, Spain, and UK post Covid-19 to further promote local procurement policies that restrict access to government contracts.

Local Production – Produce strategic drugs locally using 3D printing with relaxation in FDA rules to ease manufacturing.

‘Buy American’ – Impose ‘Buy American’ requirements on distributors of agricultural and medical supplies to receive government funds.

Import Restrictions – Protect IPRs on non-infringing imports of TV & radio transmitters, cameras, and telephone sets.

Canada

Canada is suffering heavily for concentrating its trade with one country (USA accounts for >70% of its exports) and its total trade fell 25 - 30% in 1Q2020 (90% from USA). Its automotive and oil exports have plummeted -83% and -55%, respectively. Further, USA’s ban (which was repealed later) on 3M restricting its exports of respirators and PPEs to Canada, further highlighted the issue.

Free Trade & Internalization - Despite its deteriorating trade balance, Canada does not intend to move towards protectionism. Instead, it plans to attract foreign capital investments in technology, health, and infrastructure while continuing to foster free trade with USA and Mexico under the new USMCA agreement that replaces NAFTA.

European Union (EU)

The economy of EU member nations is significantly dependent on trade as it accounts for 60 - 80% of their GDP. However, their economy is reeling under pressure due to political upheavals from Brexit, trade wars with USA, and the COVID-19 pandemic. The EU is also concerned about Chinese companies taking over its firms, pushing it to impose tariffs on Chinese export subsidies. However, it is far from pulling out of China but it has pushed for ‘strategic autonomy’ in key sectors by increasing regional sourcing.

Germany

As an export led economy with high trade sophistication, Germany uses its manufacturing prowess to locally produce and export. This was seen in its liberal stance on exporting COVID-19 related medical supplies and it is unlikely to disturb its export driven economy.

China+1 Strategy – Germany’s trade is deeply rooted in USA and China and hence it does not plan to shift from China but is likely to add new hubs, such as Vietnam, to expand its supplier network and meet its domestic demand. Only a quarter of its mid-size firms plan to move to other nations, such as India and Vietnam, due to the uncertainty of the US-China trade war and rising labor cost, while others plan to hold more inventory.

France

Covid-19 has sent the French economy into a steep recession due to closures across EU, which accounts for ~60% its trade. However, it plans to keep manufacturing at home and diversify near the EU bloc.

Self-Reliance - "The only answer is to build a new, stronger economic model, work and produce more, so as not to rely on others," with these words, the French President has urged the EU to be less reliant on USA and China, especially for car parts, smart phones, and pharmaceuticals. France and Germany even plan to invest EUR 8.2B to promote production of electric car batteries that is dominated by Asia.

Relocation of health industry – The French president has promised Sanofi to set up a “planning mechanism” for in-house production with a EUR 200M package and a local API Supplier.

Italy

Italy was among the first countries to face the COVID-19 outbreak and witnessed medical shortages. China helped Italy more than other EU nations, that levied export restrictions, to overcome the shortages. This may strengthen Sino-Italian ties, especially the Belt and Road Initiative (OBOR) and China also plans to participate in development of 5G in Italy. Italy also plans to promote its exports and has adopted three trade measures to internationalize its economy.

Integrated Promotion Fund – Additional funding of EUR 250M for contracting public and private bodies, and specialists to advice on how to promote internationalization of the economy.

Co-financing scheme – A fund to be established for providing non-repayable co-financing for up to 50% of the loan amount granted.

Trade Fair support – Provide extra funding for Italy’s stand at the postponed Dubai Expo and Italian Trade Agency (ICE) is refunding participants for cancelled trade fairs.

United Kingdom

Covid-19 has aggravated the economic uncertainty of the UK as its trade transition with EU ends in 2020. This will end its single market access to the EU and the ~40 trade deals that EU has struck with over 70 countries. The UK has replicated only 19 trade deals that account for a mere 8% of its exports. A No-Deal scenario is likely with USA too, its largest export partner, with whom it is yet to negotiate tariffs on ‘intermediate goods’ that contributes 40 to 60% of their trade.

China Policy – UK-China trade is deeply rooted and post Brexit, UK is keen to preserve its relationship for signing free trade deals. However, it is mulling over plans to restrict Chinese firms taking over its high-tech firms, such as digital communications and AI, and Chinese students accessing research at UK Universities due to security concerns.

Japan

Japan is currently the only nation to have announced unilateral measures to bring production back home. The drivers for this are to repatriate drugs and automotive supply chains, lower transport costs, rising labor costs in China, weakening Yen, and increasing domestic demand for high quality ‘Made in Japan’.

Financial Incentive – Announced an emergency financial stimulus of USD 2 billion for firms to move back to Japan and a USD 216 million fund for firms wishing to ‘diversify’ their operations.

Tariff Wars - Japan has also suspended concessions in retaliation to USA extending import duties.

Export Oriented Agreements – The Japan-Europe Economic Partnership, and the Comprehensive and Progressive Trans Pacific Partnership Agreements have won Japan lower tariffs, thus improving the competitiveness of its exports.

Australia

Australia, headquarters of one of the world’s largest PPE producer, Ansell, levied export restrictions on PPE and sanitizers citing hoarding and price-gouging. This aggravated tensions with China, already heightened by the ban on China’s Huawei to participate in the 5G rollout over security concerns, and the origins of COVID-19 outbreak. In retaliation, China recently banned meat imports from Australia.

Diversification – Australia had, even before the COVID-19 outbreak, started trying to diversify its markets by launching negotiations for free trade with eight nations including Indonesia, India, Japan, South Korea, and UK.

Financial Assistance – It has promised to help local firms identify alternative export markets or supply chains post the Covid-19 pandemic.

Local Production – It has increased the budget of the Primary Industry Productivity Enhancement Scheme to provide concessional loans to support primary producers of dairy and meat.

Amidst the chaos due to the COVID-19 pandemic, the future of trade remains uncertain but it presents an opportunity to clean up the fragile and complex global supply chain. Developed countries will look to reshuffle, reduce, localize, and regionalise in a bid to revive economic growth at the cost of globalization. However, this will take some time to manifest before we know what global trade will look like in the new future.

Whatever the outcome, one theory has certainly gained worldwide momentum - that of greater ‘Self-reliance’.

In the next article, we cover the trade impact of Covid-19 on developing economies and the trade measures they plan to take to sustain economic growth.

Comments